This highlighted section represents the expenses “incurred” against the budget. In simple math terms, BUDGET = INCURRED + REMAINING. It also shows the total amount deducted against the budget (“INCURRED”) and the total amount remaining in the budget (“REMAINING”). This header displays the total budget amount (“BUDGET”) that you set on the budget worksheet (discussed later). The explanations below follow the numbering on the Overview image:

BUDGET AND EXPENSE TRACKER HOW TO

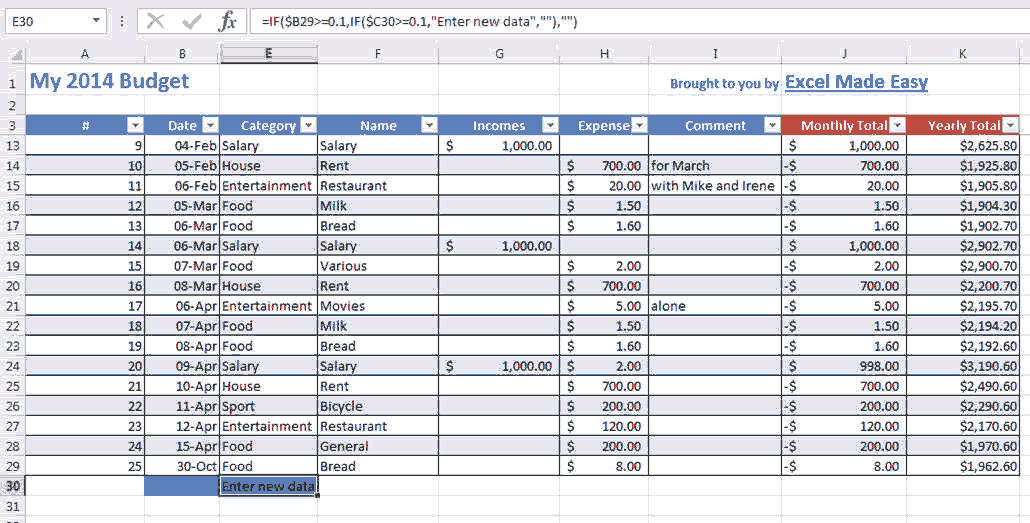

I’ll show you how to enter the expenses in the Adding Data section but, for now, let’s cover the bird’s eye view. We’ll also use this data throughout the article to discuss specific features. I’ve populated the spreadsheet with some sample data so you can get a better idea of how this template works (see the Overview image). Let’s take a quick look at the main worksheet to see if this template will meet your needs. In the rest of the article, I’ll assume that you’ve collected some transaction data and have a basic idea of your monthly expenses so that we can start setting up the budget information.) Quick Overview At that point, you can then start to utilize the budget worksheet.

( Note: You can also start with this spreadsheet to track your spending and leave the budget information blank until you get an idea of your expenses. Adding budget information is one of the first steps in this Expense Tracker spreadsheet, and I’ll cover it in the Creating the Budget section of this article. Once you’ve evaluated your spending, determined all of your recurring expenses, and created a base-line (your minimum monthly expense projections) then you’re ready to create a monthly budget.

BUDGET AND EXPENSE TRACKER PLUS

That spreadsheet is a great first step to managing your spending habits because it allows you to track your expenses plus gives you some great tools to analyze them. In a previous article ( Daily Expense Sheet), I covered another expense tracking spreadsheet. A good budget plan will always include an allowance for building up your savings and long-term investments. Simply defined, a budget is an estimate of revenues and expenses over a period of time, coupled with a plan on how surpluses are to be invested or spent. The beauty of this Expense Tracker spreadsheet is that it also includes a simple “Budget Snapshot” worksheet. Rich, poor, middle-class, no matter where you are financially, a budget can most likely improve your financial situation.” “Budgets are extremely important, and I believe that nearly everyone should have one. Michelle Schroeder-Gardner, the owner of the award-winning financial advice blog Making Sense of Cents agrees. Most financial experts list “budgeting” as a critical element for financial stability. This free, downloadable Expense Tracker spreadsheet can help you track your expenses and, if needed, give yourself a personal finance makeover. If we’re not careful, we can lose track of “where all the money goes.” I appreciate the no-waiting, gas-saving convenience. An with these apps, making a purchase is one click away.

With them, you browse an online store that uses big-data and state-of-the-art algorithms to focus what you see on what you’re most likely to buy. After all, your credit card is probably already saved to the phone’s memory. Run a search and the first few hits are paid ads, and making a purchase is probably two touches away. Do you find yourself wondering where all the money goes? In the world today, spending money is as easy as opening your browser (yes, the one on your phone… that’s always with you).

0 kommentar(er)

0 kommentar(er)